Mar 18, 2025

A bubble in gold? Hardly…

George

GoldPrecious Metals

Viewing the gold price in a vacuum, some may think there is a bubble in gold, but that is far from the case

The gold price is, after all, doing this…

Just last week the gold price ticked our target of 3000+, which was established in 2020 as gold topped out and began its handle-making phase and pattern consolidation, after making a higher right side high to its massive and bullish Cup pattern.

Is this round number target (it was actually the Cup's measurement) a stop sign? Maybe, for a while. Maybe not. Targets are objectives, not earth shattering conclusions, and bull markets do not go straight up.

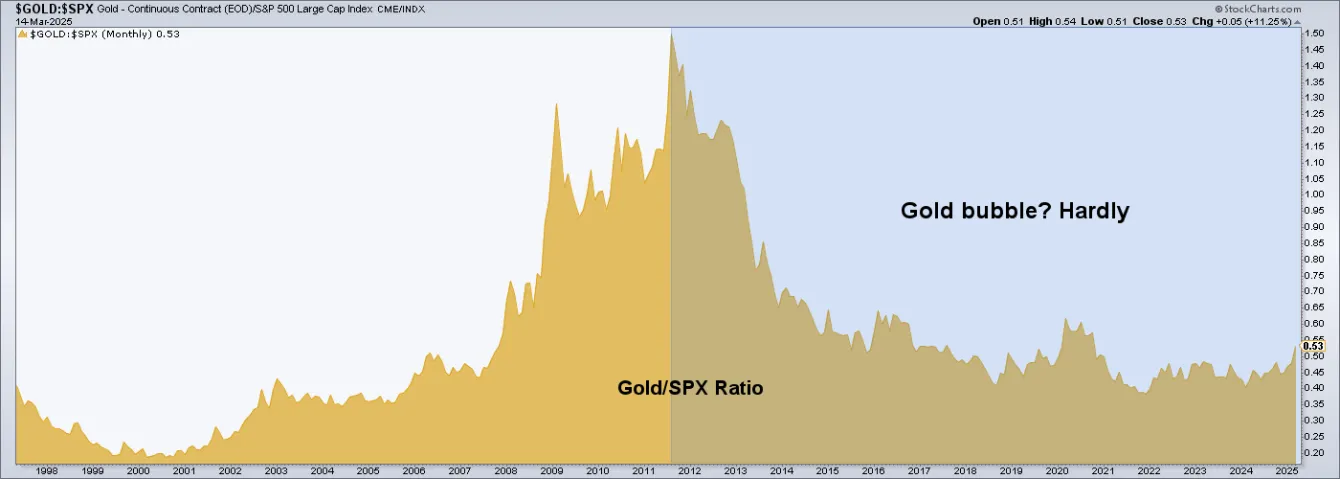

Aside from gold's nominal price, I have frequently presented this chart of the gold price relative to the S&P 500. This shows who has really been the recipient of official (Fed and government) inflationary policies since 2011, and who has not.

But in looking through nftrh.com's extensive Links page, I reacquainted myself with Macrotrends, a helpful website that holds a lot of ratio charts of various markets. It's a nice visual nerd fest. Below is one that goes well with my assertion in the chart above.

A bubble in gold? Hardly, as compared to the bubble in Monetary Base, which is a way of saying the bubble in monetary policy. I have been assigning the real bubble dynamics to monetary and fiscal policy, with the stock market simply being bubble beneficiary #1. Gold, on the other hand… Palookaville.

-

Introduction

https://www.businesstomark.com/gold-depot-feels/IntroductionIn today's unpredictable economic enviro…

-

Goldepot x Delivers Reliable Daily Returns with Real-Time Gold Arbitrage

As economic uncertainty continues to impact traditional investment strategies, investors are increas…

-

Goldepot Unlocks Real-Time Wealth Growth with Automated Gold Arbitrage System

As economic instability and market volatility challenge traditional investment strategies, Goldepot,…

-

Gold isn’t out of the woods just yet, but its bullish potential remains

Disappointing economic data, coupled with cooling inflation pressures, has pushed gold prices back a…

-

Transparent Settlement and Daily Profit Confirmation

With Donald Trump in the political spotlight and Elon Musk's Department of Government Efficiency (DO…

-

Gold Remains Strong as Central Banks Sustain Upward Gold Buying Trend in 2024

HSBC Raises Gold Price ForecastDue to geopolitical tensiAs we enter the final stretch of 2024 with t…

-

Gold Proves Surprisingly Buoyant Amid Cryptocurrency Concerns

Gold has proved surprisingly buoyant to climb above $1,700 an ounce benefiting from a weakening in t…

-

2020 Was a Stellar Year For Gold & Silver Bullion Coin Sales

The year 2020 was a very strong one for bullion coins sales by the major national mints, with the US…