May 20, 2025

You asked, we answered: Does gold qualify as an HQLA under Basel III?

kevin

GoldPrecious Metals

Gold's role in Basel III

The Basel III requirements were first published in 2010 but its implementation has been years in the making. Most provisions have been in place since 2019, but its most recent iteration, dubbed Basel III Endgame (or Basel 3.1), was due to take effect in July 2025. While it now seems that Endgame will be delayed,1 there has been renewed interest in the rules and implications of its framework. The role of gold within Basel III was no exception. But, not surprisingly, there were also a fair number of misconceptions.

In a recent article, Norton Rose Fulbright reviewed the Basel Framework and regulatory status of gold, covering gold's treatment under Basel III through the perspective of: 1) regulatory capital; 2) capital requirements; 3) collateral requirements – for credit mitigation as well as clearing counterparties and derivatives; and 4) liquidity requirements.2

The LBMA also set out to correct misleading information circulating online,3 highlighting that while gold is a Tier 1 asset for purposes of capital requirements with a 0% risk weight under the Risk Weighted Asset rules, and can be used as collateral with a 20% haircut, it is not currently defined as an HQLA for purposes of the Liquidity Coverage Ratio (LCR) and with an 85% Required Stable Funding (RSF) under the Net Stable Funding Ratio (NSFR).

What's in a name? A practical perspective of HQLAs

Despite not being officially recognised as an HQLA, gold surely behaves like one. Over the years, we have collaborated with academics and the LBMA in multiple studies that have shown that gold meets many of the criteria that determine HQLAs.

These characteristics, as defined in the Basel Framework, are divided into two categories: fundamental and market related.

Fundamental characteristics include

- Low risk – gold is an asset that does not hold credit risk

- Ease and certainty of valuation – while gold does not fit common valuation models used for bonds or some stocks, its behaviour is determined by market equilibrium with readily available market prices

- Low correlation with risky assets – gold is an effective diversifier that performs well in periods of crisis.

Market related characteristics include:

- Active and sizable market – the gold market is large and liquid, trading more than US$120bn per day on average on the over-the-counter market alone

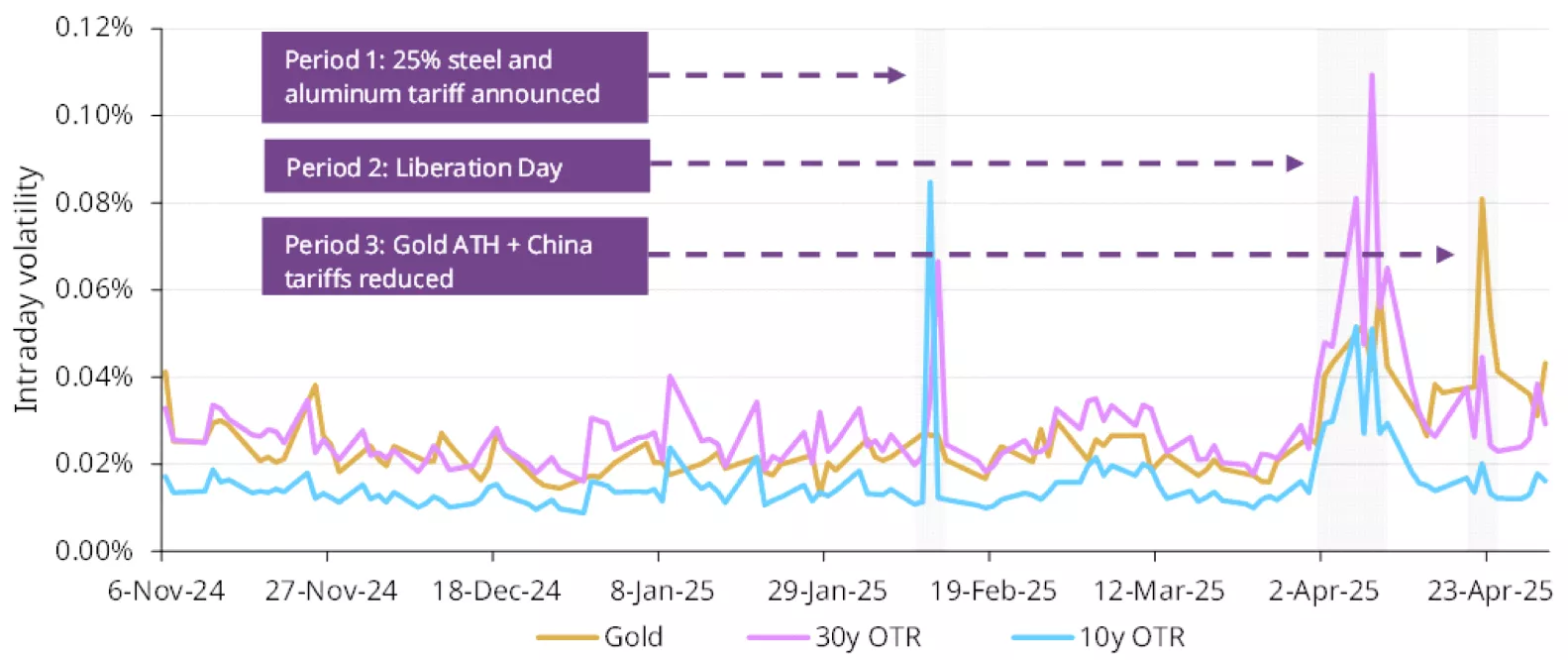

- Low volatility – gold's volatility is at par with that of 30-year US Treasuries and below of individual stocks

- Flight to quality – gold tends to be the recipient of investment flows during periods of risk, also seen through its negative correlation to the stock market.

Our report Gold: an HQLA in all but name finds that over the past six months gold has shown characteristics associated with HQLAs, including:

- Volatility: gold demonstrated comparable or superior stability to intermediate and long-term US Treasuries during recent market shocks, highlighting its lower-- than-assumed volatility profile

- Spreads: gold's bid-ask spreads remained narrow – or normalised quickly – during periods of market stress, rivalling those seen in 10- and 30-year US Treasuries

- Volume: gold's robust daily trading volumes rival those of 10-year US Treasuries, reinforcing its status as a deep and actively traded market.

The report also contrasts gold's behaviour with that of equities, some of which may technically qualify as Level 2B assets under Basel III. Yet, gold outperforms them in virtually every metric.

-

How Does Gold Perform When Stock Markets Crash?

We'll leave other pundits and analysts to guess at the "why" behind the almighty Black Monday slump …

-

Stay the course because gold still has plenty of potential - Incrementum’s In Gold We Trust

While gold has seen an impressive run this year, with prices rallying to a record high of $3,500 an …

-

Gold is not in a bubble! Prices to hit new highs in second half - Metals Focus

While gold prices have consolidated above $3,000 an ounce for the past month, investors have not tak…

-

Forget Elon Musk and DOGE: Now Congress is looking to audit America’s gold in Fort Knox

"The lack of proper audits of America's gold is highly alarming and totally unacceptable — such shod…

-

Wall Street stays cautious on gold, Main Street grows more optimistic with Fed-moving inflation data mid-week

The latest Kitco News Weekly Gold Survey showed industry experts evenly divided on gold's prospects,…

-

Why Gold, Why Now? A Generational Opportunity.

In the last five years, gold prices have risen mostly because of strong demand from central banks an…

-

GOLD RUSH Americans can swerve taxes by using gold & silver to make purchases under July 1 law – but it’s only in certain places

A NEW law could completely change the way some Americans pay for their everyday items.The proposed …

-

Gold Price Rebounds 2% as Dollar Falls Amid US-China Tensions

GOLD PRICES surged as much as 2.0% on Monday as the US Dollar sank towards this spring's 3-year lows…

-

Continue to Invest in Gold, at Least for Another Year

June 2, 2025 (Maple Hill Syndicate) - About 14 months ago, I wrote a column about gold. I don't thi…

-

Gold Set to Shine as OECD Flags Policy Risk and Negative Real Rates

OECD slashes U.S. growth outlook as inflation rises. Traders brace for hawkish Fed policy, a firm do…